Customers being one of the valuable assets of any company, one of the primary goals of most business owners, is to attract as many customers (potential and actual) as possible. They always strive to generate more leads, carefully nurture them, convert them into their long-time customers. With that being said, irrespective of domain of the businesses, it is also of paramount importance to understand whether it costs more to acquire new customers of a certain type as opposed to others, or whether it is more expensive to maintain relationship with a particular customer than another, or whether it is more costly to maintain a relationship with an existing customer than it is to attract new customer.

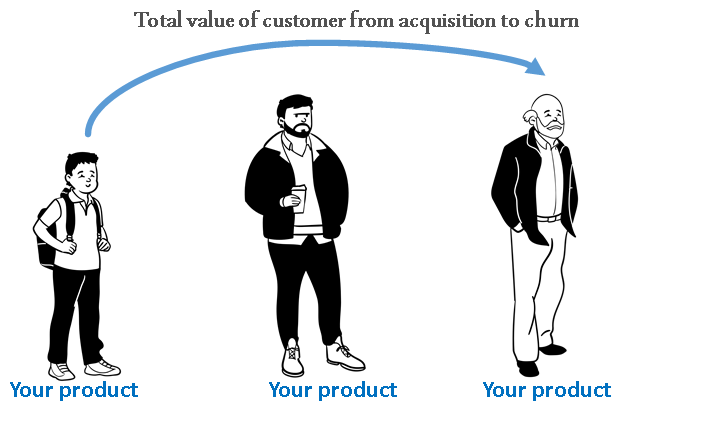

Customer lifetime value (CLV) is an important metric that businesses use to measure the success of their marketing and sales efforts. It represents how much profit a customer will bring to your company throughout their entire relationship with you, rather than just in a single transaction or purchase. CLV is also known as customer equity, customer value, or customer asset, depending on the type of business and the way the measurement is used. Regardless of what you call it, understanding CLV will help you see where your company stands right now and how to improve moving forward.

What is Customer Lifetime Value?

The customer lifetime value, as its name rightly suggests, measures how much a typical client is worth to your company over the course of their entire relationship. One of the first mentions of customer lifetime value was in the 1988 book Database Marketing: Strategy and Implementation written by Robert Shaw and Merlin Stone. Since then, early adopters have begun putting the concept into practise, and it has mostly kept up with the speed and increasing complexity of the customer experience. It is an important metric to know because it determines how much money should be spent customer acquisition versus customer retention.

It is important for businesses to understand who the good customers are and who are not, so they can adjust investments in good ones and bring everybody to profitability. Standard tool for this is the estimation of customer lifetime value. Simply put it is an estimate of the value that we expect to gain from a customer, whether it is in terms of spend, or margin for a number of future periods, typically 3 to 5 years. Customer Lifetime Value identifies the customers who have spent a lot of money, impacting revenue till it is profitable. So, it predicts customers with a value that benefits a company by aiding in campaign targeting, identifying the customers to receive rewards as an appraisal, and improving the marketing strategy.

CLTV is one of the most important metrics to track in any business. It allows us to see how much money can be expected from each of the customers over time. It can help us make better decisions about marketing, sales, and product development. It can also help us decide how much to invest in customer acquisition. We can use CLV to forecast how much we’ll make from new customers and determine if the investment is worth it. We’ll need to forecast customer lifetime value to secure funding and for making decisions about hiring and investments.

Why Other Metrics Are Not Enough

Businesses monitor a variety of crucial measures, including net new consumers, customer acquisition costs, and retention rate. They do not, however, provide you with all the information you require. Consider the retention rate as an illustration. A high retention rate indicates that you have many devoted clients who make recurrent purchases. However, it doesn’t indicate how much those clients are shelling out or how much profit you’re making. The retention rate is merely a component of the problem. You can get the whole picture using CLV.

How to calculate CLTV?

Identifying the method of computing CLTV is one of the most important strategic decisions that every organization must make. We can use below template of questions to ask the business and determine how to calculate and report LTV:

- How many separate products do we sell?

- Do customers buy multiple products from us?

- Will customers buy the same product multiple times?

- How do our customers use our products/services and pay (monthly or annually)?

- How do we know when a customer has churned and won’t come back?

- Do we upsell/Cross-sell to customers?

- What is the fulfilment channel that we are using?

The method used to calculate CLTV varies depending on the type of business and how customers are acquired and engaged.

CLTV for Retail Business

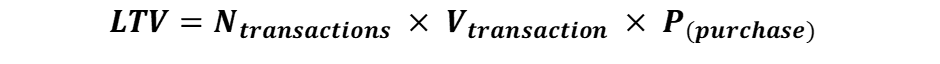

For retail businesses, to calculate CLTV, we look at historical record of purchases and calculate following values

- Number of transactions per customer

- Average value of each transaction

- The probability that the customer will buy

Once we have these values, we can simply multiply them to get the LTV of a customer:

Note: we can build a machine learning model to predict the probability of customer purchase

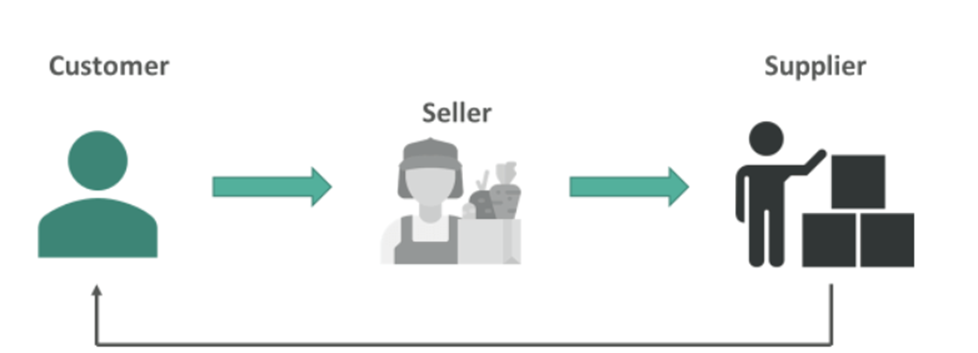

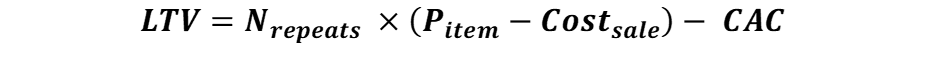

CLTV for businesses that use third party fulfillment

For businesses that use 3rd party apps such as Amazon, flipkart,Ajio like e-commerce apps, it is difficult to collect customer information. In such cases, we have to calculate following values:

- price of an item

- costs of the sale (shipping, Amazon fees, etc.)

- total number of times you expect the customer to buy from you

- customer acquisition cost (CAC) such as any ads or search placement fees you pay either Google or Amazon to get the LTV

once we have this data, we can subtract the costs of the sale from price and multiply by the total number purchases to get the LTV of customer.

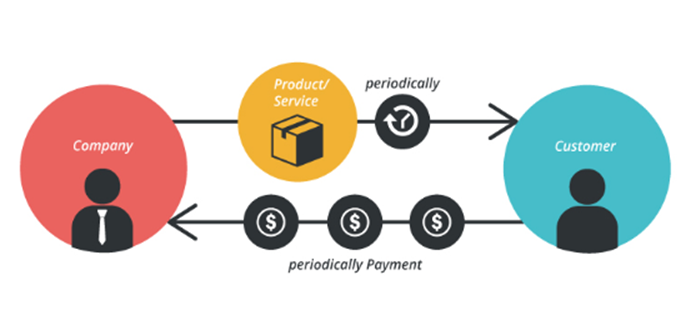

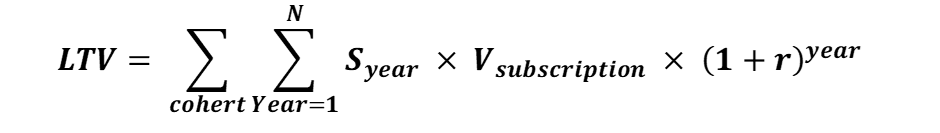

CLTV for subscription-based businesses

For businesses that provide fixed fee services based on subscription, we have to calculate following values:

- survival rate by year

- value of a subscription (This can be computed by subtracting the cost of providing the service and the customer acquisition cost)

- discount rate

- number of years (N)

Note: Typically, you can compute it based on the historical records and can extrapolate the curve. So, N tends to be the year at which survival rate by year drops below 1%

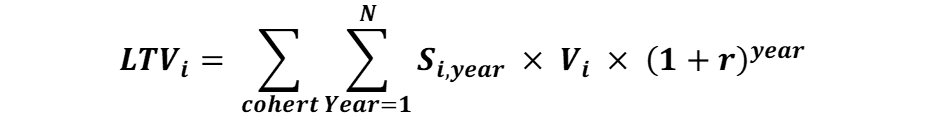

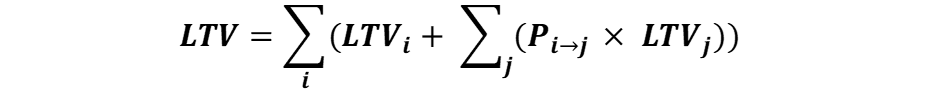

CLTV for business having cross-sell opportunities

For businesses that have multiple subscription products, it is quite likely that they will be able to cross-sell a new product to current subscribers. So, LTV calculation has to take this into account by considering the likelihood of such cross-sell. The way to do this is to compute the LTV of the ith product and then add in the likelihood of being able to cross-sell the jth product to subscribers of the ith one:

Then, add in the likelihood of being able to cross-sell the jth product to subscribers of the ith one:

We can do this year on year to estimate the probability of being able to cross-sell in year 1, year 2

Note: we can build a machine learning model to predict likelihood of being able to cross-sell.

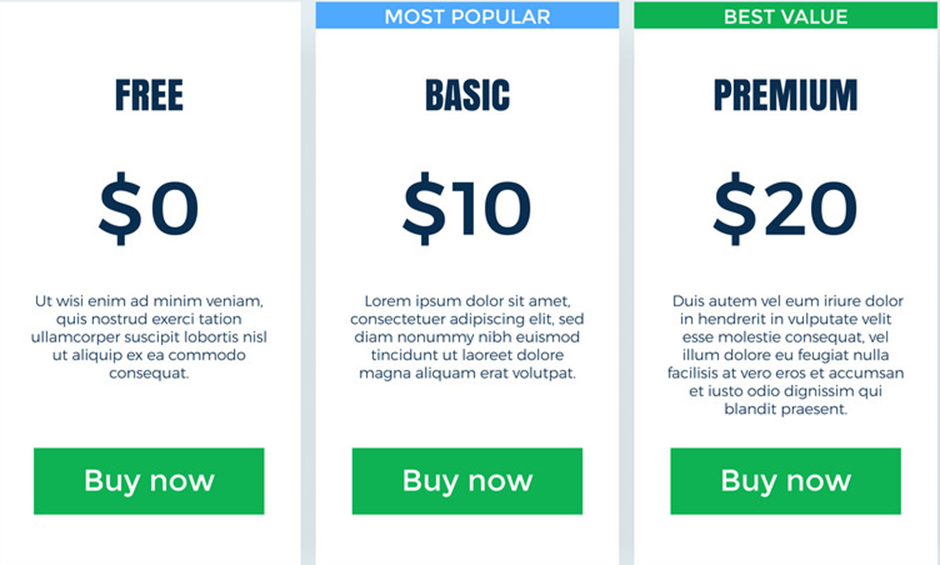

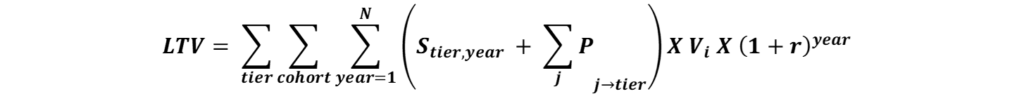

CLTV for businesses having multi-tier products

In case of businesses with multi-tier products, customers will be exclusively using only one service (Someone who bought a premium-tier will not buy the basic one that year). Each of the tiers can be considered a separate subscription product and we can simply add up the LTV of the products. In reality, people will not just churn out. They may move to the higher-level service or to the lower-level service. To capture this, we need to calculate and use the probability of a customer moving to a different tier of service.

Note: we can build a machine learning model to find out the probability of a customer moving to a different tier of service.

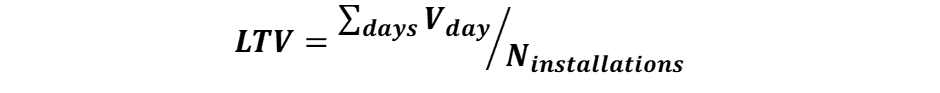

CLTV for businesses generating revenue with Ads

For add supported businesses where the product is free, and revenue is generated based on ads and in-app purchases, it is difficult to get information about individual customers. Instead, compute the LTV through a cohort consisting of people who installed the app on a specific day.

We can calculate value of that cohort by adding the ads revenue from ads displayed to that cohort and revenue from in-app purchases.

How to Increase Customer Lifetime Value

The best strategy to enhance CLV is to design and offer a fantastic product and experience from beginning to end that will entice your consumers to return repeatedly. There are a couple further measures you can take. – Recognize who your greatest clients are. Put your company’s focus on the clients who are contributing to the most revenue. You must be aware of their wants and needs if you want to maintain generating more income. You must also understand how to entice them to return for more. – Make retention investments Long-term returns on a minor retention investment can be substantial. More money will be made by keeping your top clients than by obtaining new ones. Additionally, it will enhance your CLV.

Offer outstanding customer service- A satisfied customer is a devoted one. Exceptional customer service will help you raise your CLV and retention rates.

How internal teams of an organization can help increase CLTV

- The development team can contribute to CLTV by increasing the average number of transactions (retail CLTV), or the number of years that a customer stays (subscription CLTV), or the likelihood that a customer opting for next tier (multitier CLTV).

- The operations team can improve the operational efficiency and thereby increase the value per transaction. operational efficiency could be achieved by reducing shipping times, reducing manufacturing costs, etc.

- The marketing team can concentrate on ads that are targeted for specific group of customers to increase the probability of purchase and the likelihood of cross-sell and up-sell.

- The support team could help by increasing the effectiveness of customer service to reduce customer churn

CLTV is an important metric that every business should track. It helps us understand how much money we can expect to make from each of our customers over time and how much we can expect to spend acquiring new customers. It also allows us to forecast how much we’ll make from new customers and determine if the investment is worth it.

By understanding CLTV, we can make better decisions about marketing, sales, and product development. We can also determine how much to invest in customer acquisition by calculating it. To increase your CLV, create an outstanding product and experience, and invest in retention.

Please get in touch with us at connect@ngenux.com to know how to effectively calculate CLTV for your business and use it to supercharge your business decisions and boost revenue.